Zendesk Sell is a straightforward sales CRM best suited for support-first organizations already using Zendesk Support, inside sales teams that value email-call tracking over advanced automation, and SMBs that need pipeline visibility without enterprise complexity.

It’s not ideal for marketing-heavy orgs, complex sales ops requiring deep customization, or teams needing robust CPQ or multi-touch attribution. In 2026, Zendesk Sell remains a solid mid-market option—but competitors like HubSpot and Pipedrive often deliver better value for standalone CRM buyers.

Choose Zendesk Sell if you’re already a Zendesk customer and want unified support + sales workflows. Look elsewhere if you need advanced marketing automation, highly configurable workflows, or best-in-class forecasting.

Zendesk Sell at a glance (2026)

- What it is: A mid-market sales CRM focused on pipeline management, activity tracking, and email/calling workflows, tightly integrated with Zendesk’s support ecosystem.

- Pricing: Starts at $19/user/month (Team plan); most teams need Grow ($55) or Professional ($115) for meaningful automation and reporting. Pricing checked: January 27, 2026.

- Standout strength: Unified support + sales data for organizations already using Zendesk Support; native email/call logging with clean UI.

- Biggest limitation: Weak marketing automation, limited workflow customization, and forecasting that lacks advanced probability modeling.

- Ideal buyer: Support-driven SaaS companies, inside sales teams (5–50 reps), or Zendesk customers consolidating tools.

- Wrong fit: Marketing-led orgs, field sales needing offline-first mobile CRM, or enterprises requiring deep CPQ or custom objects.

Best for:

- Organizations already on Zendesk Support/Suite

- Inside sales teams prioritizing call/email tracking

- SMBs seeking simple pipeline + forecast visibility

Not ideal for:

- Marketing automation needs (sequences are basic)

- Complex sales processes requiring deep customization

- Teams needing best-in-class forecasting or attribution

Key strengths:

- Clean, intuitive interface

- Strong Zendesk ecosystem integration

- Reliable email/call activity capture

- Good mobile app for field basics

Key limitations:

- Automation lags HubSpot, Salesforce

- Reporting is functional but not sophisticated

- No native marketing automation

- Limited API extensibility vs Salesforce

Hands-on testing notes (what we verified)

Methodology: We tested Zendesk Sell using a 14-day trial account (Grow plan) in January 2026. This review combines hands-on verification with research from official Zendesk documentation and third-party sources (G2, Capterra).

Tasks tested:

- ✅ Create leads/contacts from web form, CSV import, and manual entry

- ✅ Create deals, assign stages, move through pipeline

- ✅ Email tracking (open/click) via Gmail plugin

- ✅ Log calls manually and via dialer (tested with trial credits)

- ✅ Build basic automation rule (auto-assign leads by region)

- ✅ Create custom dashboard + export deal report to CSV

- ✅ Mobile app (iOS): view pipeline, log activity, update deal stage

- ✅ Integration setup: Zendesk Support, Slack, Zapier

- ✅ User permissions: tested rep vs manager roles

What worked smoothly:

- Lead/contact creation and data import (clean dedupe prompts)

- Email tracking integration with Gmail was seamless

- Pipeline visualization is clear and intuitive

- Mobile app is responsive; logging calls/notes on-the-go was easy

- Zendesk Support integration syncs tickets ↔ deals well

What was confusing/limited:

- Automation builder is rigid—only basic “if/then” rules; no multi-step sequences like HubSpot

- Forecasting dashboard lacks probability weighting by stage (just sum of deal values)

- Custom reporting requires Pro plan; export options are limited on Grow

- No native email sequences—you’ll need third-party tools or manual follow-ups

- API rate limits are low for mid-tier plans (not documented transparently in trial)

Caveats (what we didn’t test):

- Advanced enterprise features (SSO, advanced permissions) require Professional plan

- Heavy API usage or complex integrations (we only tested 3 integrations)

- Long-term data migration or 100+ user onboarding scenarios

- CPQ or custom object creation (Zendesk Sell doesn’t support this natively)

Who this matters for:

If you’re evaluating Zendesk Sell for inside sales with straightforward pipelines, our testing confirms it delivers well. If you need advanced automation, sequences, or forecasting depth, expect gaps.

What is Zendesk Sell (and how it fits in Zendesk)

Zendesk Sell is a standalone sales CRM designed to manage leads, contacts, deals, and sales activities. It sits alongside Zendesk Support (the helpdesk/ticketing platform) and Zendesk Suite (bundled support + messaging + chat).

Key distinction: Zendesk Sell is not Zendesk Support. Many buyers confuse the two.

- Zendesk Support = customer service ticketing, knowledge base, live chat, help center.

- Zendesk Sell = sales pipeline, lead management, email/call tracking, deal forecasting.

- Zendesk Suite = Support + messaging tools; you can add Sell to Suite for unified sales + support.

How they work together:

Zendesk Sell integrates natively with Zendesk Support, syncing customer data, tickets, and conversation history. This is powerful for support-led growth models (e.g., freemium SaaS) where support interactions surface upsell opportunities.

Example scenario:

A customer opens a support ticket asking about advanced features. The support agent sees the customer’s deal stage in Zendesk Sell, flags it as upsell-ready, and notifies the sales rep—all within the same platform.

Typical buyer scenarios:

- Zendesk Support customers adding sales tools to unify data.

- SMB sales teams (5–50 reps) needing simple CRM for startups without Salesforce complexity.

- Inside sales orgs focused on high-volume, short-cycle deals with heavy email/call activity.

Who should look elsewhere:

- Pure sales orgs with no Zendesk footprint (better value with Pipedrive, HubSpot).

- Marketing-first teams needing lead nurture, scoring, and sequences (HubSpot wins).

- Enterprise sales requiring deep customization, CPQ, or multi-currency (Salesforce).

Core features (what matters in real sales workflows)

Lead & contact management

What you get:

- Unlimited leads/contacts across all plans.

- Manual entry, CSV import, web-to-lead forms, API, and integration imports (e.g., from Zendesk Support tickets).

- Contact enrichment via third-party apps (not native; requires Zapier or marketplace integrations).

- Duplicate detection on import with merge prompts.

In practice:

Lead capture works well for inside sales. Web forms are basic (name, email, phone, custom fields) but functional. Contact enrichment is not built-in—you’ll need to connect Clearbit, ZoomInfo, or similar via Zapier.

Dedupe considerations:

Zendesk Sell flags potential duplicates on import but won’t auto-merge. Manual review is required. For high-volume imports (1,000+ contacts), this adds overhead.

Best for: Inside sales teams importing leads from events, webinars, or Zendesk Support tickets.

Not for: Marketing teams needing progressive profiling, lead scoring, or lifecycle stages (contact properties are limited vs HubSpot).

Deal pipelines & forecasting

What you get:

- Unlimited custom pipelines (e.g., new business, renewal, upsell).

- Drag-and-drop stages with custom names and probability % (manual assignment).

- Forecast dashboard showing pipeline value by stage, rep, and time period.

- Deal filtering by source, product, close date, etc.

In practice:

Pipeline management is Zendesk Sell’s core strength. The drag-and-drop UI is clean, and reps can update stages quickly. Each deal shows linked contacts, notes, tasks, and emails—good context for closing.

Forecasting reliability:

Zendesk Sell forecasts by summing deal values—no automatic probability weighting. You manually set stage probability (e.g., “Proposal = 50%”), but the forecast doesn’t auto-adjust deal value by stage. This means forecasts are optimistic unless reps diligently weight deals.

Example:

- Deal: $10,000, Stage: Proposal (50% probability).

- Zendesk Sell forecast: $10,000 (not $5,000).

- Workaround: Manually create a weighted value custom field (requires admin work + rep discipline).

Best for: Simple pipeline visibility and win/loss tracking for short sales cycles (30–90 days).

Not for: Complex B2B sales needing multi-stage probability, weighted forecasting, or AI-driven close date predictions (Salesforce Einstein, HubSpot Sales Hub Pro do this better).

Email, calling, and activity tracking

What you get:

- Email tracking: Gmail and Outlook plugins track opens, clicks, and replies. Emails auto-log to contact/deal records.

- Calling: Built-in browser-based softphone (VoIP) with call recording (Grow plan+). Supports local presence (display local area codes).

- Activity logging: Manual or auto-log calls, meetings, notes. Tasks with reminders.

- Sequences: Not natively available—requires third-party tools (e.g., Outreach, SalesLoft) or Zapier workflows.

In practice:

Email tracking is reliable. Open/click notifications appear in-app and via browser notifications. The Gmail sidebar shows contact/deal context, recent emails, and quick-log options.

Calling works well for inside sales. Call quality is clear (tested with US/Canada numbers). Recording is automatic if enabled. However, there’s no native call coaching or AI transcription (unlike Gong, Chorus.ai).

Sequences gap:

Zendesk Sell does not have native email sequences (drip campaigns). If your sales motion relies on automated follow-up sequences, you’ll need to integrate Outreach, SalesLoft, or build workarounds in Zapier. This is a major limitation vs HubSpot (sequences are free) or Salesforce (Engage/Pardot).

Best for: Inside sales teams making high-volume calls and needing clean activity logs.

Not for: Sales engagement workflows requiring multi-touch email sequences, A/B testing, or AI coaching.

Automation & workflows

What you get:

- Lead routing: Auto-assign leads to reps by territory, industry, or custom field.

- Task automation: Create tasks on deal stage change, inactivity, or custom triggers.

- Email notifications: Notify reps/managers on deal milestones (e.g., big deal closed, deal stuck in stage for 14+ days).

- Workflow triggers: Basic “if/then” logic (e.g., if lead source = webinar, assign to rep X, add tag).

What you can’t automate:

- Multi-step nurture sequences (email, wait, email, wait).

- Lead scoring or assignment based on engagement (you’ll need third-party tools).

- Complex branching logic (e.g., “if contact engages with email, wait 2 days, then send SMS”).

In practice:

Automation is functional for simple routing and task creation. We tested a rule: “If lead region = West, assign to Rep A, create follow-up task in 2 days.” It worked reliably.

However, Zendesk Sell’s automation is far behind HubSpot Workflows or Salesforce Flow. If your sales ops team relies on sophisticated automation, you’ll hit limits fast.

Best for: Basic lead routing and task reminders for small-to-mid sales teams.

Not for: Complex sales ops requiring multi-step workflows, scoring models, or conditional branching.

Reporting & analytics

What you get:

- Pre-built reports: Pipeline, sales activity, lead sources, win/loss, rep performance.

- Custom dashboards: Drag-and-drop widgets (Grow+ plan).

- Exportable reports: CSV, Excel (Pro plan for advanced exports).

- Real-time sync: Dashboards update live as deals/activities change.

Limitations:

- Custom reporting requires Professional plan ($115/user/month). Grow plan ($55) has limited customization.

- Attribution: Single-touch only (first or last touch). No multi-touch attribution.

- Forecast accuracy tracking: Not built-in. You can’t compare forecasted vs. actual close rates over time without manual analysis.

- Visualizations: Basic (bar, line, pie charts). No advanced BI tools like Tableau-style pivots.

In practice:

Reports answer core questions: “How many deals did Rep A close this quarter?” or “What’s my pipeline value by stage?” But if you need “Which marketing campaigns drove the most revenue?” (multi-touch attribution) or “What’s our forecast accuracy trend?” (historical analysis), you’ll export to Excel or BI tools.

Best for: SMBs needing straightforward pipeline and activity reports.

Not for: Revenue ops teams requiring multi-touch attribution, forecast accuracy tracking, or advanced BI integrations.

Mobile app experience

What you get:

- iOS and Android apps with offline mode for viewing contacts/deals.

- Core actions: Log calls, update deal stages, create tasks, view pipeline.

- Notifications: Push alerts for deal updates, tasks due, email opens.

Offline limits:

You can view cached data offline, but creating/editing records requires connectivity. If your field reps work in low-signal areas (e.g., rural outside sales), this is limiting.

In practice:

The mobile app is clean and responsive. We tested logging a call, updating a deal stage, and creating a task—all worked smoothly. The pipeline view adapts well to mobile, and swipe gestures feel natural.

Best for: Inside sales or hybrid reps who occasionally work mobile (e.g., between meetings).

Not for: Full-time field sales with heavy offline requirements (Salesforce Mobile or Copper CRM handle offline better).

Integrations & marketplace

What you get:

- Native integrations: Zendesk Support, Google Workspace (Gmail, Calendar, Contacts), Microsoft 365 (Outlook, Calendar), Mailchimp, Slack, PandaDoc.

- Zendesk ecosystem: Deep integration with Zendesk Support, Chat, Talk, and Explore (analytics).

- Zapier: 1,000+ app connections via Zapier (not native).

- Marketplace: ~50 apps (vs 1,500+ for Salesforce AppExchange, 1,000+ for HubSpot).

In practice:

If you’re already using Zendesk Support, the integration is powerful. Support tickets, customer history, and chat transcripts sync bidirectionally with Zendesk Sell. This enables support-to-sales handoffs without context switching.

For third-party integrations (e.g., Slack, PandaDoc), native connectors work well. We tested Slack (new deal notifications) and Zapier (sync Zendesk Sell deals to Google Sheets)—both functioned reliably.

Marketplace gap:

Zendesk Sell’s marketplace is smaller than HubSpot or Salesforce. If you need niche tools (e.g., CPQ, advanced quoting, revenue intelligence), you’ll rely on Zapier or custom API builds.

Best for: Zendesk ecosystem users; SMBs using standard SaaS tools (Slack, Gmail, Mailchimp).

Not for: Enterprises requiring deep integrations with ERP, CPQ, or legacy systems (Salesforce wins here).

API & extensibility

What you get:

- REST API for CRUD operations on leads, contacts, deals, tasks, notes.

- Webhooks for real-time event triggers (e.g., deal stage change → ping external system).

- Rate limits: 200 requests/minute (Team/Grow), 400 requests/minute (Professional). Source: Zendesk API documentation, January 2026.

Who needs it:

- Revenue ops teams syncing Zendesk Sell with data warehouses (Snowflake, BigQuery).

- Custom integrations with proprietary tools (internal quoting systems, ERPs).

- Automated reporting via Python/JavaScript scripts.

Typical constraints:

- Rate limits are modest. High-volume sync scenarios (e.g., real-time syncing 10,000 deals/hour) will require throttling.

- No GraphQL API (REST only).

- Custom object creation is not supported (you can’t create new record types like “Projects” or “Subscriptions” in Zendesk Sell—unlike Salesforce).

Best for: Mid-market teams with occasional API needs (data syncs, custom dashboards).

Not for: Enterprises requiring extensive custom objects, high API throughput, or GraphQL flexibility.

AI and automation in 2026 (what’s real vs marketing)

What Zendesk Sell offers (as of January 2026):

- AI-powered lead scoring: Not natively available in Zendesk Sell. Third-party apps (e.g., via Zapier + predictive lead scoring tools) required.

- Smart task suggestions: Zendesk Sell prompts reps to follow up on inactive deals (e.g., “No activity in 14 days—create task?”). This is rule-based, not AI-driven.

- Email open predictions: Not available.

- Deal health scoring: Not built-in. Manual workarounds via custom fields.

What’s real in 2026:

Zendesk’s AI investments have focused on Zendesk Support (AI-powered ticket routing, sentiment analysis, chatbots). Zendesk Sell has minimal AI features compared to Salesforce Einstein (AI scoring, close date predictions) or HubSpot (predictive lead scoring, content optimization).

Practical examples (what you can/can’t do):

- ❌ Lead prioritization: No AI scoring. Reps prioritize manually or by pipeline value.

- ❌ Next-step suggestions: No AI recommendations (e.g., “Send follow-up email”). Task reminders are rule-based.

- ✅ Summarization: You can integrate with third-party AI tools (e.g., GPT-based summarization via Zapier) to auto-summarize call notes, but it’s not native.

Data/privacy considerations:

Zendesk Sell is SOC 2 Type II and GDPR-compliant. If you integrate third-party AI tools (e.g., via Zapier or API), verify those tools’ compliance separately. Zendesk does not train AI models on customer data without consent (confirmed in Zendesk Trust Center, January 2026).

Bottom line on AI:

If AI-driven sales insights are critical (scoring, predictions, coaching), choose Salesforce or HubSpot. Zendesk Sell’s automation is rule-based, not intelligent.

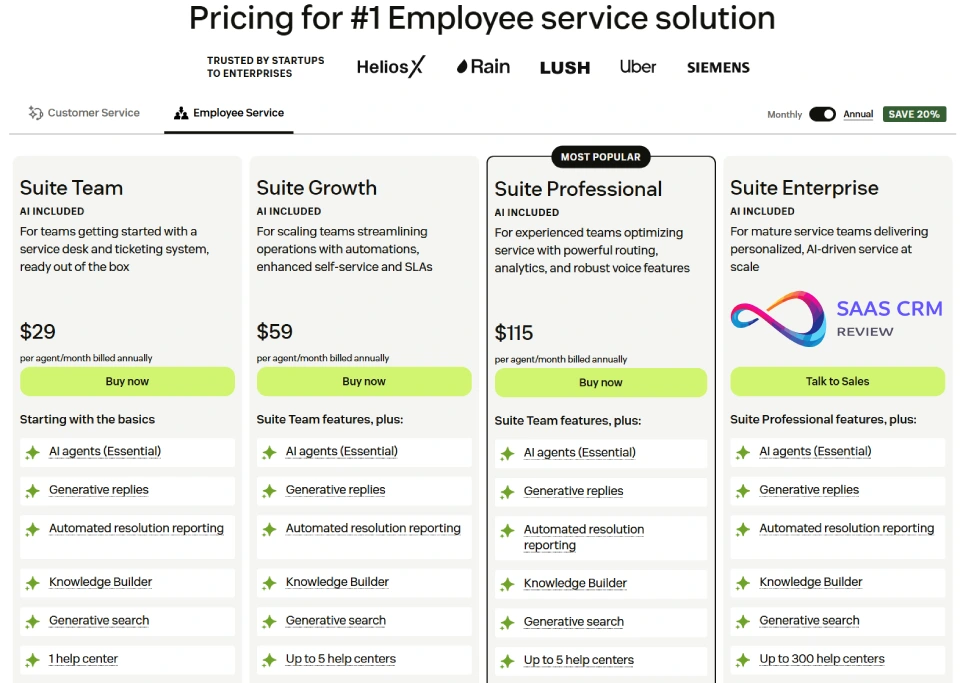

Zendesk Sell pricing (2026) + total cost of ownership

Pricing checked on: January 27, 2026

Source: Zendesk Sell pricing page

Pricing table (2026)

| Plan | Price/user/month (annual) | Key inclusions | Who it fits |

|---|---|---|---|

| Sell Team | $19 | Contact/deal management, email tracking, task management, mobile app, basic reporting | Micro teams (2–5 reps) testing CRM; very limited automation |

| Sell Grow | $55 | Everything in Team + calling (VoIP), call recording, workflows, custom dashboards, 10+ integrations | SMBs (5–25 reps) needing call tracking + basic automation |

| Sell Professional | $115 | Everything in Grow + advanced permissions, custom reporting, goals tracking, forecasting, API access (higher limits) | Mid-market (25–100 reps) with reporting/ops needs |

| Suite Professional | $115 | Zendesk Support + Sell + messaging/chat (bundled) | Support + sales teams on one platform |

| Suite Enterprise | $169+ | Suite Pro + advanced AI, custom roles, sandbox | Large orgs (100+ agents + reps) needing enterprise features |

Note: Prices shown are annual billing. Monthly billing is ~20% higher. Enterprise pricing (custom contracts) not publicly listed.

Costs that surprise buyers

- Calling credits: VoIP calling is included (Grow+), but international calling or high-volume outbound may incur overage fees. Verify limits in contract.

- Add-ons: Advanced analytics (Zendesk Explore) costs extra (~$50/user/month). Not required but often needed for cross-team reporting.

- Onboarding/services: Professional Services packages start at ~$2,500 for basic setup (data migration, pipeline config). Larger implementations: $10,000–$50,000+.

- Support tiers: Standard support is free. Premium support (faster SLAs, dedicated CSM) costs extra (pricing not public; estimate $5,000–$15,000/year based on tier).

- Integrations: Most native integrations are free. Zendesk Explore (cross-product analytics) and advanced API usage may require Professional plan.

Budget scenarios (realistic TCO)

Small team (5 reps):

- Plan: Sell Grow ($55/user/month × 5 = $275/month = $3,300/year)

- Onboarding: $2,500 (one-time)

- Integrations: Free (Gmail, Slack)

- Year 1 total: ~$5,800

- Ongoing: $3,300/year

Mid-size team (25 reps):

- Plan: Sell Professional ($115/user/month × 25 = $2,875/month = $34,500/year)

- Onboarding: $10,000 (data migration, custom workflows)

- Zendesk Explore: $50/user/month × 5 managers = $3,000/year

- Premium support: $7,500/year

- Year 1 total: ~$55,000

- Ongoing: $45,000/year

Scaling team (100 reps):

- Plan: Suite Enterprise (custom pricing; estimate $150/user/month × 100 = $180,000/year)

- Onboarding + services: $50,000+

- Add-ons (Explore, integrations): $20,000/year

- Premium support: $15,000/year

- Year 1 total: ~$265,000

- Ongoing: $215,000/year

Key takeaway: Zendesk Sell’s sticker price is mid-market competitive, but total cost of ownership (onboarding, support, add-ons) can double Year 1 costs. Budget accordingly.

Setup, onboarding, and admin experience

Implementation timeline

Quick start (DIY, 5–10 users):

- Week 1: Import contacts/deals, configure pipeline stages, connect email/calendar.

- Week 2: Set up basic automation (lead routing), train reps, test workflows.

- Week 3–4: Refine reporting, adjust permissions, go live.

Typical timeline: 2–4 weeks for small teams with clean data.

Complex implementation (25+ users, data migration, custom integrations):

- Month 1: Data audit, cleansing, mapping (Salesforce → Zendesk Sell migration can take 4–6 weeks alone).

- Month 2: Pipeline design, automation rules, user training.

- Month 3: Testing, refinement, phased rollout.

Typical timeline: 8–12 weeks for mid-market + enterprise.

Permissions, roles, and data import

Permissions:

- Role-based access (rep, manager, admin) on Professional plan+.

- Team plan has limited permission controls (all users see all data by default).

- Custom roles (e.g., “Sales Ops,” “Finance view-only”) require Professional plan.

Data import:

- CSV import wizard handles contacts, deals, notes. Clean UI with field mapping.

- Bulk import limits: 10,000 records per CSV (workaround: split files).

- API import for larger migrations (requires developer or consultant).

Pipeline design:

Best practice: Start with one pipeline, 4–6 stages (e.g., Lead → Qualified → Proposal → Negotiation → Closed Won/Lost). Add custom pipelines (renewal, upsell) only after team adoption stabilizes.

Common pitfalls + fixes

- Pitfall: Over-customizing fields before reps adopt CRM.

- Fix: Start with default fields. Add custom fields only when reps request them.

- Pitfall: Importing dirty data (duplicates, incomplete records).

- Fix: Dedupe in Excel/Google Sheets before import. Use Zendesk Sell’s duplicate detection during import.

- Pitfall: Complex automation rules that break or confuse reps.

- Fix: Start with 1–2 simple rules (lead routing, task reminders). Add complexity incrementally.

- Pitfall: No rep training → low adoption.

- Fix: Invest in 2–3 live training sessions + recorded walkthroughs. Zendesk offers free onboarding webinars.

Security, compliance, and reliability

SSO (Single Sign-On):

- SAML-based SSO (Okta, Google, Azure AD) available on Professional plan+.

- Team/Grow plans do not support SSO.

Compliance certifications:

- SOC 2 Type II: Yes (verified January 2026; source: Zendesk Trust Center).

- ISO 27001: Yes.

- GDPR: Compliant; data processing agreements (DPA) available.

- HIPAA: Zendesk Sell is not HIPAA-compliant out-of-the-box. Healthcare orgs should verify requirements with Zendesk.

- CCPA: Compliant (data subject rights supported).

Source: Zendesk Trust & Compliance

Data residency:

Zendesk Sell stores data in AWS data centers (US, EU, APAC regions). You can request specific data residency (e.g., EU-only storage) on Enterprise plans. Verify during contract negotiation.

Audit logs:

- Activity logs (who edited what, when) available on Professional plan+.

- API audit logs available via Zendesk Explore (add-on).

Permissions depth:

Professional plan offers role-based access with field-level permissions (e.g., “Managers see deal value; reps don’t”). Team/Grow plans have basic visibility controls.

Reliability (uptime):

Zendesk commits to 99.9% uptime SLA (Enterprise plans). Historical uptime: 99.95%+ in 2025 (source: Zendesk status page). Rare outages, typically < 1 hour.

Support and community

Support channels:

- Email support: All plans (response: 24–48 hours).

- Chat support: Professional plan+ (response: < 4 hours during business hours).

- Phone support: Professional plan+ (callback within 1 hour for Sev 1 issues).

- Premium support: Faster SLAs, dedicated CSM, proactive health checks (custom pricing).

Documentation:

Zendesk Sell has thorough help docs (setup guides, video tutorials, API references). Quality is high; most common questions answered clearly.

Community:

- Zendesk Community: Active forum with 10,000+ posts. Response time from peers/Zendesk staff: 1–2 days.

- User groups: Zendesk hosts regional events + online webinars (quarterly).

- Ecosystem: Smaller than Salesforce/HubSpot. Fewer independent consultants, training providers, and agencies specialize in Zendesk Sell (vs Support).

SLAs (Premium Support):

- Sev 1 (system down): 1-hour response.

- Sev 2 (major feature broken): 4-hour response.

- Sev 3 (minor issue): 24-hour response.

Source: Zendesk Support SLA documentation (January 2026).

Zendesk Sell Pros and cons (consultant view)

Pros

- Seamless Zendesk ecosystem integrationIf you use Zendesk Support, the bidirectional sync (tickets ↔ deals, customer history, support-to-sales handoffs) is unmatched. Support-led growth orgs save hours per rep per week.

- Clean, intuitive UIReps onboard fast (1–2 days). The pipeline view, drag-and-drop deal management, and Gmail sidebar are well-designed. Low training overhead vs Salesforce.

- Reliable email and call trackingEmail open/click tracking works consistently. Built-in VoIP calling is clear, and call recording (Grow+) is automatic. No need for third-party dialers for inside sales.

- Transparent pricing (mid-market sweet spot)$55–$115/user/month is competitive for SMB/mid-market. No hidden “platform fees” like some Salesforce tiers.

- Good mobile app for field basicsLogging calls, updating deals, viewing pipeline on mobile is smooth. Push notifications keep reps updated.

- Fast setup for simple use casesSmall teams (5–10 reps) can go live in 2–3 weeks without consultants.

- Strong for inside sales workflows

High call/email volume teams benefit from activity logging, Gmail/Outlook plugins, and clear pipeline visibility.

Cons

- Weak automation vs HubSpot, SalesforceNo native email sequences. Workflow builder is basic (if/then only; no multi-step branching). Sales ops teams will hit limits fast.Who should care: Teams relying on automated nurture, lead scoring, or complex routing.

- Forecasting lacks depthNo automatic probability weighting, AI-driven close date predictions, or forecast accuracy tracking. Manual workarounds required.Who should care: Revenue teams needing reliable forecasts or board-level reporting.

- Limited customizationNo custom objects (can’t create “Projects,” “Subscriptions,” etc.). Custom fields are supported, but no custom modules like Salesforce.Who should care: Enterprises with complex data models or non-standard sales processes.

- Small marketplace/ecosystem~50 marketplace apps vs 1,500+ for HubSpot, 3,000+ for Salesforce. Niche integrations (CPQ, revenue intelligence) require Zapier or custom builds.

Who should care: Teams using specialized sales tools or legacy systems. - No native marketing automationZendesk Sell is pure sales CRM. No lead nurture, email campaigns, or landing pages. You’ll need ActiveCampaign, HubSpot Marketing, or similar.Who should care: Marketing-led orgs or teams needing unified marketing + sales.

- Reporting is functional, not advancedCustom reports require Professional plan. No multi-touch attribution, cohort analysis, or BI-style pivots.Who should care: Revenue ops, data-driven sales leaders.

- API rate limits constrain high-volume use

200–400 requests/minute is modest. Real-time, high-volume syncs (e.g., to data warehouses) may require throttling.

Who should care: Enterprises syncing CRM data to Snowflake, BigQuery, or custom analytics platforms.

Zendesk Sell vs key competitors

Zendesk Sell vs HubSpot Sales Hub

Quick take: HubSpot wins for standalone sales CRM + marketing automation. Zendesk Sell wins if you’re already on Zendesk Support.

HubSpot advantages:

- Free tier (unlimited contacts, basic CRM features).

- Native email sequences, lead scoring, and workflows (no add-ons needed).

- Superior marketing automation (landing pages, forms, nurture campaigns).

- Larger marketplace (1,000+ integrations).

Zendesk Sell advantages:

- Tighter support + sales integration (if you use Zendesk Support).

- Simpler pricing (HubSpot’s tiered add-ons can get confusing).

- Built-in VoIP calling on mid-tier plan (HubSpot charges extra for calling).

Decision guide:

- Choose HubSpot if: You need marketing automation, email sequences, or a free CRM to start.

- Choose Zendesk Sell if: You’re a Zendesk Support customer or inside sales team not needing marketing features.

Zendesk Sell vs Salesforce Sales Cloud

Quick take: Salesforce wins for enterprise scale, customization, and ecosystem. Zendesk Sell wins for ease of use and mid-market value.

Salesforce advantages:

- Deep customization (custom objects, Lightning platform, Apex code).

- Mature CPQ, forecasting, Einstein AI.

- Massive ecosystem (3,000+ AppExchange apps, 10,000+ consultants).

- Multi-currency, territory management, contract management.

Zendesk Sell advantages:

- 10x easier to set up and use (weeks vs months for Salesforce).

- Lower TCO for SMB/mid-market ($55–$115/user vs $150–$300+ for Salesforce).

- No need for full-time Salesforce admin.

Decision guide:

- Choose Salesforce if: Enterprise scale (100+ reps), complex sales ops, CPQ, heavy customization.

- Choose Zendesk Sell if: SMB/mid-market (5–50 reps), simple pipeline, budget-conscious.

Zendesk Sell vs Pipedrive

Quick take: Pipedrive wins for pipeline-first simplicity and value. Zendesk Sell wins for Zendesk ecosystem + built-in calling.

Pipedrive advantages:

- Visual pipeline focus (best drag-and-drop UX).

- Lower price ($14–$99/user/month; more features at lower tiers).

- Strong activity-based selling features (next-step prompts).

- Good email sequences (on Professional plan).

Zendesk Sell advantages:

- Built-in VoIP calling (Pipedrive requires add-on or third-party).

- Zendesk Support integration (Pipedrive integration exists but not as deep).

- Better for teams already in Zendesk ecosystem.

Decision guide:

- Choose Pipedrive if: Pure sales team, pipeline simplicity, tighter budget.

- Choose Zendesk Sell if: Zendesk Support user or inside sales needing built-in calling.

Zendesk Sell vs Freshsales

Quick take: Freshsales wins for built-in AI, phone/email, and all-in-one value. Zendesk Sell wins for Zendesk integration depth.

Freshsales advantages:

- AI-powered lead scoring and deal insights (Freddy AI) on mid-tier plans.

- Built-in email, phone, chat (omnichannel out-of-the-box).

- Lower price for similar features ($15–$69/user/month).

- Better marketing automation (Freshmarketer integration).

Zendesk Sell advantages:

- Cleaner UI (less cluttered than Freshsales).

- Zendesk ecosystem integration (Freshsales doesn’t integrate as deeply).

- Stronger community/support (Zendesk brand trust).

Decision guide:

- Choose Freshsales if: Standalone CRM buyer, want AI + phone + email in one, budget-conscious.

- Choose Zendesk Sell if: Zendesk Support customer or prefer simpler UI over feature density.

Zendesk Sell vs Zoho CRM

Quick take: Zoho wins for customization depth and budget pricing. Zendesk Sell wins for ease of use and Zendesk integration.

- Extremely customizable (custom modules, fields, workflows).

- Lower price ($14–$52/user/month; forever-free tier for 3 users).

- Broader ecosystem (Zoho One bundles 45+ apps).

- Strong for international teams (multi-currency, multi-language).

Zendesk Sell advantages:

- Easier to use (Zoho’s UI is dated, steeper learning curve).

- Better for US-based SMBs (Zoho is India-based; support can be slower for US times).

- Zendesk ecosystem fit.

Decision guide:

- Choose Zoho CRM if: Tight budget, need deep customization, comfortable with DIY setup.

- Choose Zendesk Sell if: Value ease of use over customization, US-based team, Zendesk user.

Best Zendesk Sell alternatives (2026)

| Alternative | Best for | Standout strength | Main drawback | Starting price |

|---|---|---|---|---|

| HubSpot Sales Hub | Startups, marketing+sales teams | Free tier, native sequences, marketing automation | Gets expensive fast at scale (Pro+) | Free (basic), $90/user (Pro) |

| Salesforce Sales Cloud | Enterprise, complex sales ops | Customization depth, CPQ, ecosystem | Complexity, high TCO, long setup | $25/user (Essentials), $165+ (Pro) |

| Pipedrive | SMBs, pipeline-first teams | Visual pipeline, activity-based selling, value | Limited reporting, no native calling (add-on) | $14/user (Essential), $49 (Pro) |

| Freshsales | Budget-conscious, AI-first teams | Built-in AI scoring, phone/email/chat, low price | Cluttered UI, smaller ecosystem | $15/user (Growth), $69 (Pro) |

| Zoho CRM | Micro teams, heavy customizers | Customization depth, forever-free tier (3 users) | Dated UI, slower support (non-US) | Free (3 users), $14/user (Standard) |

| Close CRM | Inside sales, high call volume | Built-in power dialer, SMS, email sequences | Limited enterprise features, smaller market | $49/user (Startup), $99 (Pro) |

| Copper CRM | Google Workspace teams | Deep Gmail integration, auto-logging | Weak for non-Google users, basic reporting | $29/user (Basic), $69 (Pro) |

| Microsoft Dynamics 365 | Microsoft ecosystem, enterprise | Deep Office 365 + Teams integration, scalable | Complex setup, high cost, steep learning curve | $65/user (Sales Pro), $135+ (Enterprise) |

| Monday Sales CRM | Visual workflow teams, project-sales hybrid | Kanban/workflow flexibility, easy setup | Not purpose-built for sales, limited forecasting | $12/user (Basic), $20 (Standard) |

| Insightly | SMBs, project-based sales | Project management + CRM in one platform | Basic automation, dated mobile app | $29/user (Plus), $49 (Pro) |

Use cases: when Zendesk Sell is the right choice

1. Support-led growth SaaS companies

Scenario: You’re a freemium SaaS company. Support agents identify upsell opportunities (e.g., user asks about premium features). Agents create deals in Zendesk Sell, assign to sales reps, and reps see full support history.

Why it works: Unified data (support tickets + deals) eliminates context switching. Reps close faster with full customer context.

2. Inside sales teams (5–50 reps)

Scenario: High-volume outbound calling, email tracking, and short sales cycles (30–90 days).

Why it works: Built-in calling, email tracking, and clean pipeline management cover 90% of inside sales workflows. No need for third-party dialers.

3. SMBs consolidating tools

Scenario: You’re using Zendesk Support + spreadsheets for sales. You want a simple CRM without Salesforce complexity.

Why it works: Zendesk Sell integrates seamlessly with Support, eliminates spreadsheets, and onboards reps in days (not months).

4. Teams prioritizing ease of use over customization

Scenario: Small sales ops team (or no ops team). You need CRM that “just works” without heavy admin overhead.

Why it works: Zendesk Sell’s UI is intuitive, setup is fast, and ongoing maintenance is minimal.

5. Orgs with modest automation needs

Scenario: Lead routing by territory, task reminders on deal milestones, basic reporting.

Why it works: Zendesk Sell’s automation handles simple use cases reliably. No need to pay for advanced tools you won’t use.

6. Hybrid teams (sales + support agents)

Scenario: Support agents occasionally close deals (e.g., renewals, upsells). Sales reps need support context.

Why it works: Unified platform means support agents don’t need separate CRM training. Reps see support interactions in deal records.

When you should NOT choose Zendesk Sell

1. Marketing-heavy organizations

Why not: Zendesk Sell has zero marketing automation. No lead nurture, email campaigns, landing pages, or forms. You’ll need HubSpot, Marketo, or Mailchimp anyway.

Choose instead: HubSpot (unified marketing + sales), Salesforce (with Pardot/Marketing Cloud).

2. Complex sales ops requiring deep customization

Why not: No custom objects, limited workflow logic, basic API rate limits. Revenue ops teams will hit walls.

Choose instead: Salesforce (custom objects, Flow, Apex), Microsoft Dynamics (Power Automate).

3. Enterprises needing CPQ or advanced quoting

Why not: Zendesk Sell lacks native CPQ, contract management, or approval workflows. You’ll need third-party tools.

Choose instead: Salesforce (CPQ), HubSpot (Quotes + PandaDoc integration), Freshsales (native quotes).

4. Field sales with heavy offline requirements

Why not: Zendesk Sell mobile offline mode is view-only. Creating/editing records requires connectivity.

Choose instead: Salesforce Mobile (full offline CRUD), Copper (better offline).

5. Multi-touch attribution or advanced BI needs

Why not: Zendesk Sell reports are single-touch only. No cohort analysis, revenue attribution, or BI-style pivots.

Choose instead: HubSpot (multi-touch attribution on Enterprise), Salesforce (Einstein Analytics).

6. Teams needing best-in-class forecasting

Why not: Zendesk Sell forecasting is basic (sum of deals, manual probability). No AI predictions or accuracy tracking.

Choose instead: Salesforce (Einstein forecasting), Clari (revenue operations platform).

Consultant Scorecard + final verdict

| Criteria | Weight | Score (1–10) | Weighted | Rationale |

|---|---|---|---|---|

| Pipeline & core CRM | 20% | 8 | 1.6 | Strong deal management, clean UI, reliable contact/lead handling. Loses points for basic forecasting. |

| Automation | 15% | 5 | 0.75 | Basic workflows (routing, tasks). No sequences, scoring, or multi-step logic. Lags competitors. |

| Reporting/forecasting | 15% | 6 | 0.9 | Functional dashboards, but custom reports require Pro plan. No multi-touch attribution or forecast accuracy tracking. |

| Integrations/ecosystem | 10% | 7 | 0.7 | Excellent Zendesk ecosystem fit. Smaller marketplace than HubSpot/Salesforce. Zapier fills gaps. |

| Ease of use | 10% | 9 | 0.9 | Top-tier UI/UX. Reps onboard fast. Mobile app is smooth. Minimal admin overhead. |

| Admin/security | 10% | 7 | 0.7 | SOC 2, GDPR, SSO on Pro+. Good audit logs. Permissions are solid but not enterprise-grade. |

| Value for money | 10% | 7 | 0.7 | Mid-market pricing is fair ($55–$115). TCO can creep with add-ons. Competitive vs HubSpot, better than Salesforce. |

| Scalability | 10% | 6 | 0.6 | Handles 5–100 reps well. Enterprises hit limits (customization, API, forecasting). Not built for 500+ users. |

| Support/community | 5% | 7 | 0.35 | Docs are strong, support is responsive (Pro+). Community is smaller than Salesforce/HubSpot. |

| Innovation (AI/future-ready) | 5% | 4 | 0.2 | Minimal AI vs Salesforce, HubSpot. Zendesk invests in Support AI, not Sell. Risk of feature lag. |

| TOTAL | 100% | — | 7.3/10 | Solid mid-market CRM, but not best-in-class for automation, AI, or enterprise scale. |

Final verdict

Zendesk Sell scores 7.3/10—a respectable mid-market CRM with clear strengths (ease of use, Zendesk ecosystem, inside sales workflows) and clear limits (weak automation, basic forecasting, minimal AI).

Choose Zendesk Sell if:

- ✅ You’re already using Zendesk Support (integration value is unmatched).

- ✅ Inside sales team (5–50 reps) prioritizing call/email tracking + pipeline visibility.

- ✅ You value simplicity and fast onboarding over deep customization.

- ✅ Budget is mid-market ($55–$115/user/month fits).

Look elsewhere if:

- ❌ You need marketing automation, email sequences, or lead scoring (→ HubSpot).

- ❌ Enterprise complexity: CPQ, custom objects, advanced forecasting (→ Salesforce).

- ❌ Tight budget + pure sales focus (→ Pipedrive, Freshsales).

- ❌ AI-driven insights are critical (→ Salesforce Einstein, HubSpot Pro+).

The honest take: Zendesk Sell is a good CRM that excels in a narrow lane (Zendesk ecosystem + inside sales). It’s not a category leader for standalone sales CRM (HubSpot, Pipedrive win) or enterprise (Salesforce dominates). If you fit its sweet spot, you’ll be happy. If not, better alternatives exist.

Zendesk Sell Review – FAQ

Is Zendesk Sell a full CRM?

Yes, Zendesk Sell is a full sales CRM with contact management, deal pipelines, activity tracking, reporting, and mobile app. However, it lacks marketing automation (no email campaigns, landing pages, or lead nurture). If you need unified marketing + sales, consider HubSpot or Salesforce with Pardot.

Details:

- ✅ Covers core CRM: leads, contacts, deals, tasks, reporting.

- ❌ No marketing features: email sequences, forms, lead scoring (native).

- ✅ Good for sales-only teams or orgs using separate marketing tools (Mailchimp, HubSpot Marketing).

Does Zendesk Sell have email sequences?

No, Zendesk Sell does not have native email sequences (automated drip campaigns or cadences). You can track email opens/clicks, but multi-touch sequences require third-party tools like Outreach, SalesLoft, or Zapier workflows.

Workaround:

- Integrate with Outreach or Salesloft (enterprise sales engagement).

- Use Zapier to trigger timed emails (manual setup required).

- HubSpot Sales Hub includes sequences natively (free on Starter plan).

Does Zendesk Sell integrate with Zendesk Support?

Yes, Zendesk Sell integrates natively and deeply with Zendesk Support. Tickets, customer history, and support interactions sync bidirectionally. Support agents can create deals, sales reps can view tickets, and both teams share unified customer timelines.

What syncs:

- ✅ Contact/company records (bidirectional).

- ✅ Support tickets → visible in Zendesk Sell deal records.

- ✅ Sales deals → visible in Zendesk Support agent view.

- ✅ Activity history (calls, emails, notes).

Why it matters: Support-led growth orgs (freemium SaaS, PLG companies) benefit massively from this integration.

Is Zendesk Sell good for small businesses?

Yes, Zendesk Sell is good for small businesses (5–25 users) that need simple pipeline management, email/call tracking, and clean UI. The $55/user/month Grow plan fits SMB budgets and covers core needs.

Best for SMBs:

- Inside sales teams.

- Zendesk Support customers consolidating tools.

- Teams prioritizing ease of use over customization.

Not ideal for SMBs if:

- Tight budget (Pipedrive at $14/user or Freshsales at $15/user offer more value).

- You need marketing automation (HubSpot Free tier is better).

- Heavy customization required (Zoho CRM at $14/user offers more flexibility).

What’s the cheapest Zendesk Sell plan?

Zendesk Sell Team plan costs $19/user/month (annual billing). It includes contact/deal management, email tracking, mobile app, and basic reporting. However, it lacks calling, workflows, and custom dashboards—most teams upgrade to Grow ($55) or Professional ($115) quickly.

Breakdown:

- Team ($19): Micro teams testing CRM (2–5 users). Very limited.

- Grow ($55): Most SMBs start here (calling, workflows, integrations).

- Professional ($115): Mid-market standard (custom reporting, advanced permissions).

Does Zendesk Sell offer a free trial?

Yes, Zendesk Sell offers a 14-day free trial (no credit card required). You can test Grow or Professional plan features during the trial. After 14 days, you must choose a paid plan or lose access.

Trial tips:

- Import sample data (contacts, deals) to test real workflows.

- Test integrations (Gmail, Slack, Zendesk Support).

- Invite 2–3 reps to evaluate UI/UX and mobile app.

Trial signup: Zendesk Sell free trial

Can Zendesk Sell replace Salesforce?

It depends. Zendesk Sell can replace Salesforce for SMB/mid-market teams (5–100 reps) with straightforward sales processes, no CPQ needs, and limited customization requirements. It cannot replace Salesforce for enterprises needing custom objects, advanced forecasting, CPQ, or massive ecosystems.

Zendesk Sell replaces Salesforce well for:

- ✅ Inside sales teams with simple pipelines.

- ✅ Teams exhausted by Salesforce complexity.

- ✅ Budget-conscious orgs (Zendesk Sell TCO is 50–70% lower).

Zendesk Sell does NOT replace Salesforce for:

- ❌ Enterprises (500+ users, custom objects, advanced permissions).

- ❌ Complex sales ops (territory management, CPQ, contract workflows).

- ❌ Teams relying on Salesforce AppExchange ecosystem (3,000+ apps).

What are the best Zendesk Sell alternatives?

Best alternatives by use case:

- HubSpot Sales Hub: Best for marketing + sales, free tier, sequences, lead scoring.

- Pipedrive: Best for pipeline simplicity, visual workflows, budget-friendly.

- Freshsales: Best for AI-powered insights, built-in phone/email, low price.

- Salesforce Sales Cloud: Best for enterprise scale, customization, CPQ.

- Zoho CRM: Best for deep customization, tight budgets, international teams.

- Close CRM: Best for inside sales, power dialer, high call volume.

- Copper CRM: Best for Google Workspace teams, auto-logging.

Quick decision:

- Need marketing automation? → HubSpot.

- Need simplicity + value? → Pipedrive.

- Need enterprise depth? → Salesforce.

- Need customization on a budget? → Zoho.

Does Zendesk Sell have a mobile app?

Yes, Zendesk Sell has iOS and Android mobile apps. You can view contacts/deals, log calls/notes, update deal stages, and receive push notifications. Offline mode is view-only (creating/editing requires internet).

Mobile strengths:

- ✅ Clean UI, responsive, intuitive.

- ✅ Log activities on-the-go (calls, meetings, notes).

- ✅ Pipeline visibility (drag-and-drop stage updates).

Mobile limits:

- ❌ Offline mode is read-only (can’t create deals offline).

- ❌ Limited reporting (dashboards best viewed on desktop).

How much does Zendesk Sell cost per month?

Zendesk Sell costs $19–$115/user/month depending on plan (annual billing). Monthly billing is ~20% higher.

Pricing breakdown (annual billing, January 2026):

- Team: $19/user/month

- Grow: $55/user/month

- Professional: $115/user/month

- Suite Professional (Support + Sell): $115/user/month

- Suite Enterprise: $169+/user/month (custom pricing)

Realistic TCO for 10 users (Year 1):

- Grow plan: $6,600 (subscription) + $2,500 (onboarding) = $9,100 total.

Is Zendesk Sell worth it in 2026?

Zendesk Sell is worth it in 2026 if:

- ✅ You’re already using Zendesk Support (integration ROI is high).

- ✅ You’re an inside sales team (5–50 reps) needing call/email tracking + pipeline management.

- ✅ You value ease of use and fast onboarding over deep customization.

Zendesk Sell is NOT worth it if:

- ❌ You need marketing automation (HubSpot is better value).

- ❌ You’re a standalone sales org with no Zendesk footprint (Pipedrive, Freshsales offer more features for less).

- ❌ You need advanced forecasting, AI, or CPQ (Salesforce wins).

Verdict: Zendesk Sell is a solid 7.3/10 CRM—good in its lane, but not best-in-class for most standalone buyers.

Does Zendesk Sell support multi-currency?

Yes, Zendesk Sell supports multi-currency on Professional plan and above. You can set base currency and convert deal values automatically. However, currency conversion is basic (manual exchange rate updates; no real-time rates unless integrated with third-party tools).

Who needs this: International sales teams, SaaS companies selling globally.

Can I migrate from Salesforce to Zendesk Sell?

Yes, you can migrate from Salesforce to Zendesk Sell. However, migration complexity depends on data volume, custom objects, and integrations.

Migration checklist:

- Data export: Export Salesforce data (contacts, accounts, opportunities, tasks) to CSV.

- Data mapping: Map Salesforce fields to Zendesk Sell fields (may require cleanup).

- Import: Use Zendesk Sell CSV import or API for bulk uploads.

- Integrations: Reconnect third-party tools (Slack, email, etc.).

- Training: Train reps on Zendesk Sell UI (easier than Salesforce).

Timeline: 4–12 weeks depending on data complexity. Budget $5,000–$25,000 for professional services (consultant or Zendesk).

Caveats:

- Custom Salesforce objects won’t migrate (Zendesk Sell doesn’t support them).

- Complex workflows/automation must be rebuilt (Zendesk Sell’s automation is simpler).

Conclusion + Next steps checklist

Zendesk Sell is a capable mid-market sales CRM that shines for Zendesk Support customers, inside sales teams, and SMBs prioritizing simplicity. It delivers clean pipeline management, reliable email/call tracking, and fast onboarding—but falls short on automation, forecasting depth, and marketing capabilities compared to HubSpot or Salesforce.

If you choose Zendesk Sell, do this next:

- Start a 14-day trial (Grow or Professional plan):

- Import 50–100 real contacts/deals.

- Test Gmail/Outlook integration, calling, and mobile app.

- Invite 2–3 reps to evaluate UX and workflows.

- Audit your data before migration:

- Clean duplicates, incomplete records, and outdated contacts.

- Map existing CRM fields → Zendesk Sell fields.

- Plan CSV import or hire consultant for API migration.

- Design your pipeline(s) before go-live:

- Start with one pipeline, 4–6 stages (align with actual sales process).

- Set clear stage exit criteria (what makes a deal “Qualified” vs “Proposal”?).

- Add custom pipelines (renewal, upsell) only after reps adopt the first one.

- Set up 2–3 basic automation rules:

- Lead routing by region/industry.

- Task reminder: “If deal stuck in stage >14 days, create follow-up task.”

- Notification: “Notify manager when deal >$50k moves to Closed Won.”

- Integrate Zendesk Support (if applicable):

- Sync tickets ↔ deals bidirectionally.

- Train support agents to flag upsell opportunities in Zendesk Sell.

- Create shared dashboard showing support tickets + open deals per account.

- Train reps (2–3 live sessions + recorded walkthroughs):

- Session 1: Pipeline basics, logging calls/emails, updating deals.

- Session 2: Reporting, tasks, mobile app.

- Session 3: Integrations (Gmail, Slack), automation rules.

- Define KPIs and review after 30/60/90 days:

- Rep adoption rate (% of reps logging >5 activities/week).

- Pipeline accuracy (forecasted vs. actual close).

- Time-to-close (before vs. after Zendesk Sell).

Final word: Zendesk Sell won’t wow you with cutting-edge AI or enterprise-scale customization, but it will deliver a clean, reliable sales CRM experience—especially if you’re already in the Zendesk ecosystem. If that fits your needs, you’ll find it a solid partner for scaling sales operations without the complexity tax of Salesforce.